As trust in traditional banks falters, the two most iconic names in tech and finance are joining together to create what might become America’s mightiest FinTech.

Last week Apple effectively dropped the mic on the nation’s banking industry. While the average bank is paying less than a half a percent on savings accounts, the $2.6 trillion technology company announced it would be offering 4.15% annual returns to savers – no minimums, no lockups and FDIC-insured. The new product rollout comes at a time when regional banks are scrambling in the wake of the Silicon Valley Bank crisis to maintain their deposit bases, and cash-starved fintech startups are likewise struggling.

Technically Apple doesn’t have a banking license. It is fronting for Goldman Sachs Bank USA, otherwise known as Marcus, which has a state charter and is FDIC-insured. In fintech parlance, Apple is a neobank like Chime, Revolut and Monzo – except its brand strength is unparalleled given that there are more than two billion iPhones globally, now serving as Goldman’s branch network.

According to polling company Gallup’s annual “Confidence in Institutions” survey, last year, prior to SVB, only 27% of Americans reported to have a “great deal or quite a lot” of confidence in their banks. That number is down from its peak of 60% in 1979. By contrast, Apple landed in the top spot for the tenth consecutive year in 2022 according to Interbrand’s annual Global Best Brands ranking. The only bank to make the top 25 was JPMorgan, ranked at 24, just ahead of YouTube.

“Apple goes at warp speed and a lot of banks are driving 45 mph in the right lane,” says Wedbush Securities analyst Dan Ives.

The new high yield savings account is only available to customers with Apple’s credit card, Apple Card. These users can have an account set-up in minutes and their spend rewards, called daily cash, are automatically funneled into the high yield account. The account will be displayed on a dashboard in Apple’s digital wallet where users can track their balance and interest earned. The product allows Apple to offer yet another sticky iPhone benefit by strengthening its built-in digital wallet.

“It’s really a flywheel of keeping everything in the ecosystem,” says David Donovon, executive vice president of financial services for consulting firm Publicis Sapient.

Goldman’s Deposit “Run”

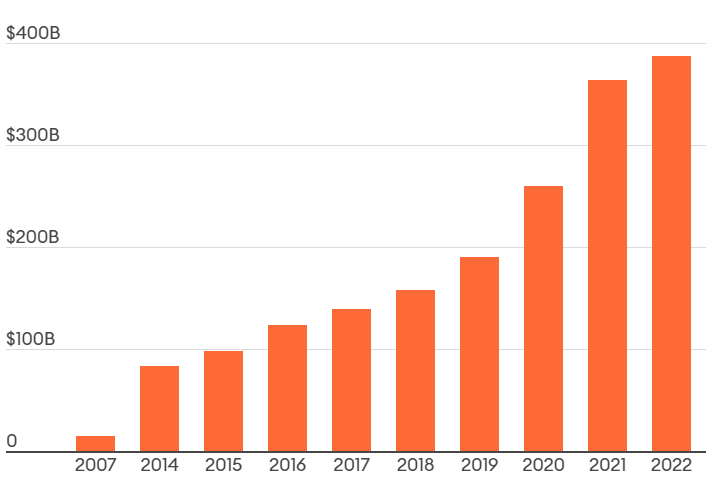

Deposits are becoming a larger source of funding for the bank as it grows the consumer and transaction banking business. Apple’s 4.15% savings account should turbocharge this trend.

The new savings account is only the latest in a series of high-profile financial offerings from the Cupertino technology blue chip. Last month, the company began offering its own buy now, pay later product giving consumers the option to split payments into four installments with zero interest or fees. In July, Apple launched tap-to-pay allowing merchants to accept card payments directly from their iPhones. By offering financial products like these to consumers and merchants, Apple is integrating itself into every aspect of its customers’ lives while collecting swipe fees and cross-selling its own products.

In all of its financial products, Goldman Sachs operates in the background, despite its own formidable reputation, suggesting that they are betting that customers no longer value the marble columns and venerable histories that thousands of redundant FDIC-insured financial institutions continue to bank on. One hundred and fifty four year old Goldman Sachs is essentially an infrastructure player not unlike Evolve and Cross River, brandless banking-as-a-service providers serving other fintechs.

“It’s partnerships like these that could basically make banking become invisible,” Chris Nichols, director of capital markets at SouthState Bank, says.